About the author: Isaiah Douglass, CFP® is a financial planner living in Noblesville, IN. He was inspired to become a financial adviser when his own experience with a financial adviser (at the age of 19) was less than stellar.

Let me start by saying if you were looking for the next significant crypto investment, sorry to disappoint. I’m not launching the latest ICO, but merely providing four financial suggestions that are easy to implement and make a substantial impact on your life.

Employer Benefits

First, if your employer offers any retirement plan (SIMPLE, SEP, 401k, 403b, or 457 plan) enroll it in. Perhaps a “duh” moment, but I’ve met high earning 20-something engineers that didn’t enroll in their 401k plan with an automatic 3% match. Take the company’s free money. Even if there is no match, there is often a taxable deduction for contributing which is still worth the effort.

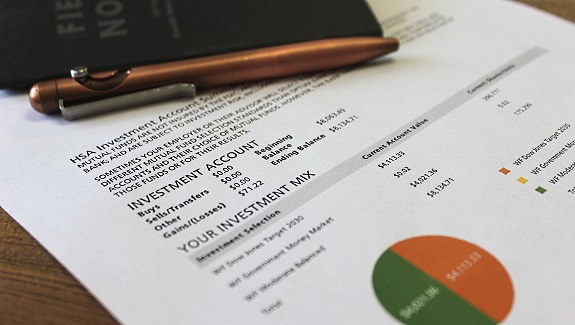

The greatest asset we all have is our health. A health savings account (HSA) allows you not only to have a tax benefit but not lose your hard-earned money on healthcare. To be eligible for an HSA, you must have coverage by a high-deductible health plan (HDHP). An HSA lowers your taxable income, grows tax-free, remains tax-free when used on healthcare costs, and remains yours even if you leave the company. If you don’t have any healthcare costs for a given year, you are just stockpiling health benefits for future you. Initially, with an HSA, you will be responsible for all healthcare costs then the health insurance company will cover the remaining. Interested in a deeper dive into an HSA? Check out this article by Michael Kitces.

HSA: another way to invest your money.

Establish a Budget

Budgeting is simple in concept but seemongly tricky for many. There are numerous free and inexpensive options on how to build and sustain a budgeting regime. NerdWallet published an excellent overview of the multiple options available. Try out the free tools and develop budgeting habits. Then if you are hitting walls and need more, pay for these tools, remembering that you get what you put in on these tools. The main reason you should budget is to find where your “leakage” exists. The amount of money you make has little correlation to your financial well-being if you cannot control spending. In today’s world of automation, it has never been easier to save and pay yourself first (savings, HSA, and investments). A general rule of thumb is that 60% of your budget is fixed costs (rent, car payment, insurance, student loans, etc.), which means you have control over 40% of your paycheck. Start slow and over time work your way up to get a better handle on your financial well-being. Doing this earlier in life, with less of an income, will make the later years much less painful.

Establish Emergency Savings

Bankrate’s latest financial security index study showed that only 39% of people could afford a $1,000 set-back if it occurred. The rule of thumb is six month’s of cash in savings if you are single, and three months if you have a dual income household. For some, only having six months of living expenses would not allow them to sleep at night. Remember that hoarding cash is never a good thing either; this provides little to no growth over inflation over long periods of time. Hit the mark you are comfortable with and then start investing for the future with the excess.

Don’t hoard it. Put some in an account that will grow.

Invest in the Future

Once you have emergency savings, maxed out your HSA and employer benefits, then you can look at other options. Many stop there, but we cannot do just those three things in our 20’s. A target savings rate for retirement should be between 10%-15% of your income annually. Self-discipline is key here. Do not get distracted by the shiny objects and blow up your savings plan. I’m a believer and fan of what the crypto movement is doing. If you don’t have the knowledge or the competitive insights, only dip your toe in the water in crypto. Do not compromise years of hard work chasing a unicorn investment. We, as 20-somethings, must be responsible for doing a better job at savings compared to our parents.

Editor’s Note: Everyone’s situation is different, and there are always exceptions to every rule. The above advice is a general guide and should not be taken as the be all end all. Know yourself, know your lifestyle, make good choices. Want more posts about financial well being? Send in your ideas/feedback to joe@dappered.com.